Ever since Vista Equity Partners acquired Marketo in May 2016, the countdown was on to see what the future would be for the industry’s gold standard marketing automation platform. Much like the Amazon HQ2 frenzy, theories ran rampant as to who the eventual acquirer would be, and everyone from Google to Salesforce made the list. After Marketo’s purchase of Bizible, it seemed like Vista was following the standard private equity formula of bundling a bunch of related technologies together for a profit. And wow did they do it perfectly! When the news broke regarding Adobe’s acquisition of Marketo, my first thought was, “The team at Vista really knows what they are doing.” Everything seemed to go according to plan.

>> Related: What You Missed Last Month at the Adobe Summit <<

In this post:

The Details of the Adobe Marketo Deal: That’s Billion, Not Million

By now we all know that Adobe acquired Marketo for $4.75 Billion. Yes, billion. In fact, it is Adobe’s largest acquisition ever. The Wall Street Journal highlights that Adobe is looking become a one-stop-shop for marketers and states, “This deal is expected to add scale to Adobe’s existing marketing-technology capabilities. It will also bolster the company’s clout with business-to-business brands, which make up the bulk of Marketo’s customer base.”

According to Marketo CEO Steve Lucas, “Adobe and Marketo both share an unwavering belief in the power of content and data to drive business results. Together we will deliver an unrivaled solution that will place customer experience and engagement at the heart of digital transformation.”

Why We’re Excited about Adobe’s Acquisition of Marketo

For Adobe, acquiring Marketo’s customer base brings them firmly into B2B territory. For Marketo, being in the Adobe portfolio brings some very exciting possibilities for a more designer-oriented UX and product integrations, including:

- Enhancing the overall Marketo UI (which has remained largely the same since Marketo’s inception) to be more in-line with the Adobe brand

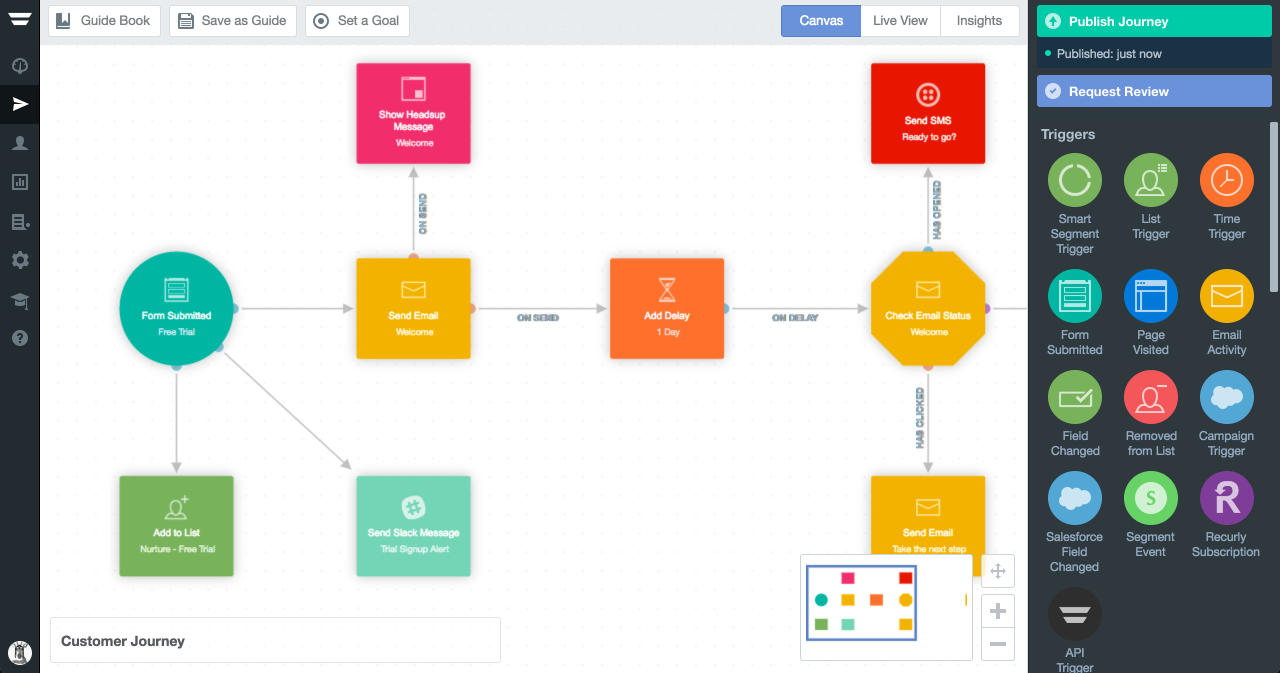

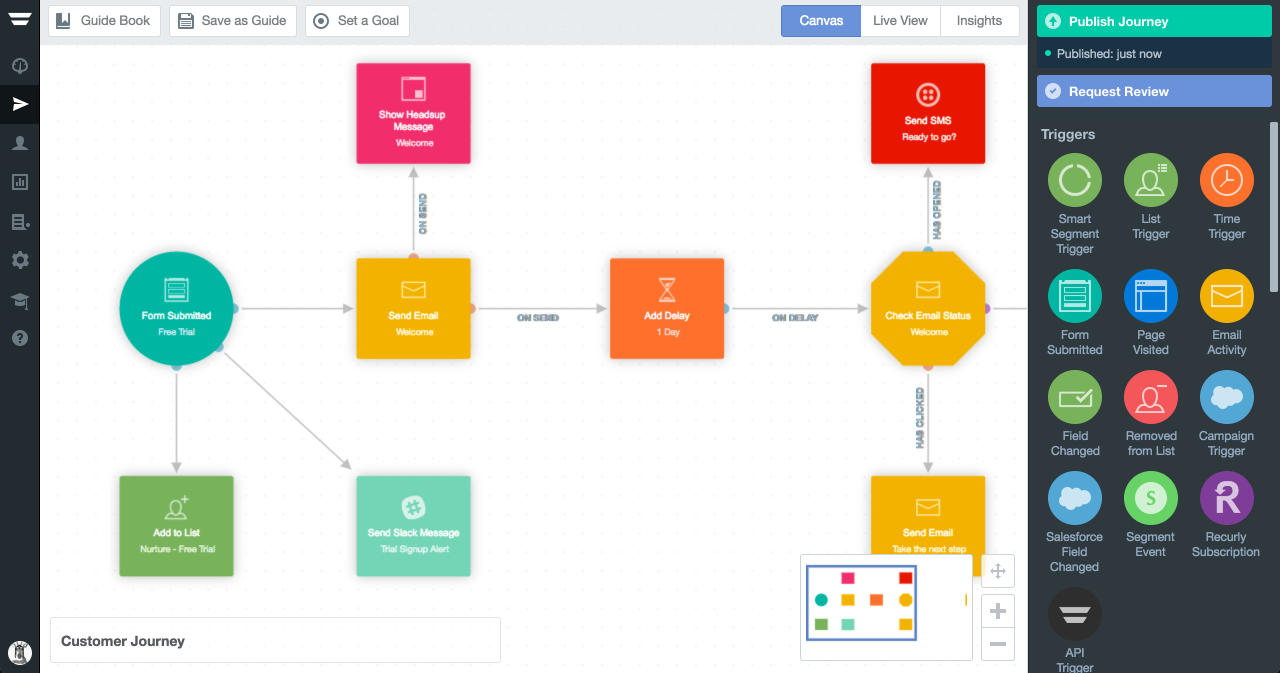

- Making the campaign building process more visual, like Eloqua’s Campaign Canvas, Pardot’s Engagement Studio, or Autopilot’s Journeys

- Seamless integrations with Adobe tools such as Dreamweaver, Photoshop, or Illustrator

Autopilot, a relatively new entrant to the marketing automation space, uses a visual campaign workflow called Journeys

Why We’re Leery of Marketo Being Acquired by Adobe

As with any big acquisition, there’s the possibility of stagnant development, lackluster support, and a loss of the community that made Marketo so attractive in the first place. I was an Eloqua customer when they got bought by Oracle, and support seemed to die overnight. The already complicated and admin-heavy platform became even more so, and with Oracle’s commitment to the high end of the enterprise market, it very clearly didn’t feel like a product for the mid-market anymore.

Marketo has built its success firmly on B2B mid-market tech companies, to the point that it has a cult-like following among marketing ops professionals in the industry. I personally hope it stays that way. Of course there’s great opportunity for Marketo to evolve into an even better platform under Adobe’s stewardship, but there’s always the worry that a company you’ve been rooting for since the beginning — a product you’ve built your career on — ceases to be the thing that makes it special. And so, we’ll be watching closely to confirm that the Marketo community remains as vibrant as ever and that product development marches forward.

A Big Question Mark for Marketo’s Analytics Capabilities

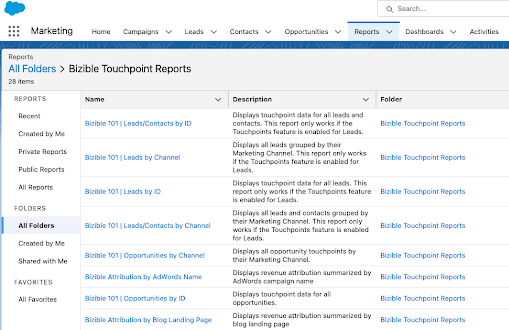

When Marketo acquired Bizible earlier this year, it was a signal that they took the marketing data problem seriously. Even with RCE and tons of reporting options in Marketo and Salesforce, most marketers still struggle to run meaningful reporting in an automated way. We work with marketing teams every week who spend a ton of time manually cobbling data together to create relatively simple reports on campaign performance and to prove marketing’s impact on revenue. While most of this reporting typically ends up in Salesforce, the vast majority of the data is populated via the marketing automation system.

Adobe doesn’t have the backbone of a company overly concerned with analytics and reporting, so it will be interesting to see if or how they tackle this. The reason Marketo is so popular among MOPs folks is because it’s flexible enough to get things legitimately correct. It takes a lot of work and data infrastructure, but if you have an idea of what you’re looking for the reporting output to be, you can construct a system in Marketo to accomplish it. If Adobe could find a way to make this infrastructure/attribution/reporting process much easier for the standard marketer to figure out, however, it would be a huge differentiator.

What It Means for the Rest of the MarTech Industry

“Adobe clearly stated their intention to expand their Marketing Cloud to compete more effectively with the leading players in marketing automation and customer relationship management space, and this is a first major step down that path,” says Ryan Duguid, chief evangelist at Nintex, a workflow automation platform.

It has also been mentioned that the Marketo deal will help Adobe “compete in marketing services against Microsoft, Oracle, SAP and even the great powers of digital advertising, Google and Facebook.” However, I foresee Salesforce feeling the largest impact of Adobe’s Marketo acquisition. Salesforce acquired marketing automation platform Pardot in 2013, and they do a phenomenal job selling the integration when in reality Pardot’s integration with Salesforce is nowhere near as robust as Marketo’s. On the business development side of the house, bundling Pardot in with Salesforce renewals and upgrades has been an effective way for Salesforce to win deals and gain market share.

But, Salesforce should be careful continuing this strategy. In many organizations, it’s typically the VP of Sales that executes the agreement with Salesforce. While the bundled deal is attractive, I’ve seen it more than once that the sales leader rushes forward to save money without consulting the marketing team on whether Pardot will meet their needs. This inevitably leads to resentment towards Pardot once marketing gets their hands on the product because 1) they weren’t a part of the evaluation process and were forced into it, and 2) Pardot is a subpar platform. This could come back to haunt Salesforce unless they can radically improve the UI and catch up on functionality.

Charting the Future of Marketing Automation

Yes, I’m a Marketo groupie, but I firmly believe that Marketo is in a position to chart the future of marketing automation. It already boasts the most robust and flexible platform compared to its mid-market competitors like Pardot and Hubspot, and its integration with Salesforce is best in class. However, leveling up the visual components of Marketo would be a welcome change, provided updates and functionality to data and analytics don’t fall by the wayside.

Want tips, tutorials, best practices, and other cool stuff delivered to your inbox every quarter? Subscribe to the Sponge newsletter >